When placing trades on any trading platform, there are two execution types offered. This is usually preset for a given instrument and cannot be changed.

Let us learn about the execution types and their features.

Instant Execution

Instant Execution is the method by which brokers execute orders at the trader’s requested price, or not at all. In other words, if the price of an instrument changes as you place an order, the broker will send you a notification (requote) to confirm you agree to the newly changed price.

Market Execution

Market Execution is the method by which traders execute orders at the current price within fractions of a second. The price can be either higher or lower than the one the trader sees in the terminal window as prices constantly change.

This execution type’s advantage is that it is the fastest available and presents the opportunity for 100% market access to traders.

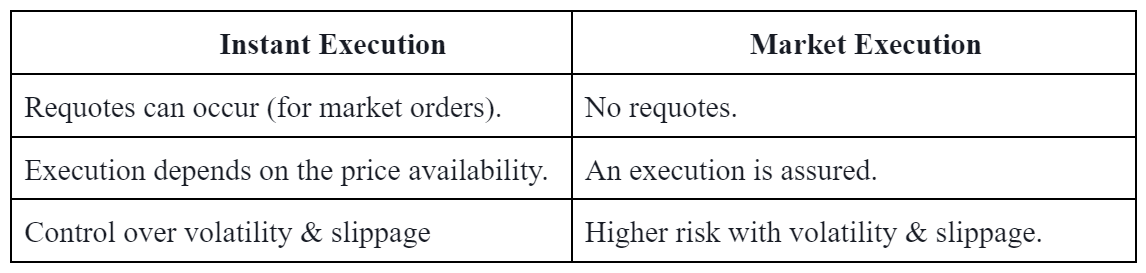

Comparison: Instant Execution vs Market Execution

One major difference between Market Execution and Instant Execution is that with the former, requotes don’t occur. However, especially during periods of market volatility, you do increase your risk as a strong fluctuation of the price in a short space of time is possible.

Let us look at a comparison table:

Volity executes orders using the Market type, Instant is the previous technology.

We wish you successful trading with Volity !